Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Time Inconsistent Control Theory With Finance Applications Springer Finance: Revolutionizing the Financial World

Imagine a world where financial decisions are always rational, individuals never procrastinate, and everything goes according to plan. Sounds too good to be true, right? Well, not anymore. Thanks to the groundbreaking Time Inconsistent Control Theory, the finance industry is undergoing a revolutionary transformation.

In this article, we will delve into the fascinating realm of Time Inconsistent Control Theory, exploring its concepts, applications in finance, and its potential to shape the future of the financial world. So, fasten your seatbelts and get ready to embark on an enthralling journey into the world of Time Inconsistent Control Theory with finance applications!

Understanding Time Inconsistent Control Theory

Time Inconsistent Control Theory, also known as the dynamic inconsistency theory, challenges the traditional notion that individuals act rationally and consistently in decision-making processes, especially in the realm of finance. It acknowledges the inherent irrationality of human behavior and explores the reasons why individuals often deviate from their long-term plans.

5 out of 5

| Language | : | English |

| File size | : | 4668 KB |

| Screen Reader | : | Supported |

| Print length | : | 559 pages |

The theory suggests that humans tend to have a present bias, meaning they prioritize immediate gratification over future benefits. This bias often leads to actions that are contrary to their initially set goals. For instance, an individual may plan to save money for retirement, but when faced with the opportunity to splurge on luxurious vacations or extravagant purchases, they succumb to their present bias, disregarding their long-term objectives.

Moreover, Time Inconsistent Control Theory acknowledges that individuals' preferences evolve over time. What may seem like the optimal decision today may no longer hold true in the future due to changing circumstances or a shifting mindset. This dynamic character of preferences creates a significant challenge for traditional financial models and theories that assume fixed preferences.

Applications of Time Inconsistent Control Theory in Finance

One of the most significant implications of Time Inconsistent Control Theory is its potential to revolutionize financial planning and investment strategies. By accounting for individuals' present bias, financial advisors and institutions can design personalized plans and products that align with their clients' ever-changing preferences.

Economic agents can take advantage of Time Inconsistent Control Theory by incorporating mechanisms that nudge individuals towards making better financial decisions. For example, employing rules that automate savings or investments can help reduce the impact of the present bias. By making contributions to retirement accounts or investment portfolios automatic and periodic, individuals are more likely to adhere to their long-term financial goals.

Furthermore, Time Inconsistent Control Theory has implications for the design of financial products. Traditional financial instruments, such as annuities or savings accounts, may not be aligned with the dynamic nature of individuals' preferences. By developing dynamic financial products that adapt to changes in preferences, financial institutions can better serve their clients' needs while mitigating the impact of present bias.

Time Inconsistent Control Theory in Behavioral Finance

Behavioral finance, a subfield of finance that combines psychological concepts with traditional economic theories, is heavily influenced by Time Inconsistent Control Theory. The theory provides a framework for understanding and explaining various behavioral phenomena observed in financial decision-making.

One key concept in behavioral finance is the notion of hyperbolic discounting. This concept suggests that individuals heavily discount the value of future rewards as the time of receipt approaches. Time Inconsistent Control Theory provides insights into the underlying psychological processes behind this behavior, helping researchers and practitioners develop strategies to mitigate its negative effects.

Moreover, Time Inconsistent Control Theory introduces the concept of commitment devices. Commitment devices are mechanisms that individuals can use to restrict their future choices and prevent themselves from succumbing to their present bias. These devices can include pre-commitment contracts, deadlines, or penalties for deviating from the initially set goals. By incorporating commitment devices, individuals can align their actions with their long-term objectives and overcome the challenges posed by time inconsistency.

The Future of Finance with Time Inconsistent Control Theory

As Time Inconsistent Control Theory gains traction in the financial industry, the future looks promising for both individuals and institutions. By harnessing the power of this theory, individuals can make more informed decisions, preserve their long-term goals, and ultimately improve their financial well-being.

Financial institutions, on the other hand, can benefit from a deeper understanding of individuals' time inconsistency. By designing products and services that cater to dynamic preferences and account for present bias, they can enhance customer satisfaction and loyalty.

In addition, the integration of Time Inconsistent Control Theory with advanced technologies, such as artificial intelligence and machine learning, opens up new horizons for personalized financial solutions. These technologies can analyze individuals' behavioral patterns, predict future preferences, and provide tailored recommendations to optimize financial decision-making.

Time Inconsistent Control Theory, with its applications in finance, has the potential to revolutionize the way we approach financial decision-making and planning. By acknowledging the inherent irrationality and time inconsistency of human behavior, this theory provides a solid foundation for developing strategies and products that align with individuals' dynamic preferences.

As we move towards a more personalized and technologically-driven financial world, Time Inconsistent Control Theory offers hope for a future where financial decisions are optimized, long-term goals are achieved, and individuals can navigate the complex financial landscape with confidence.

5 out of 5

| Language | : | English |

| File size | : | 4668 KB |

| Screen Reader | : | Supported |

| Print length | : | 559 pages |

This book is devoted to problems of stochastic control and stopping that are time inconsistent in the sense that they do not admit a Bellman optimality principle. These problems are cast in a game-theoretic framework, with the focus on subgame-perfect Nash equilibrium strategies. The general theory is illustrated with a number of finance applications.

In dynamic choice problems, time inconsistency is the rule rather than the exception. Indeed, as Robert H. Strotz pointed out in his seminal 1955 paper, relaxing the widely used ad hoc assumption of exponential discounting gives rise to time inconsistency. Other famous examples of time inconsistency include mean-variance portfolio choice and prospect theory in a dynamic context. For such models, the very concept of optimality becomes problematic, as the decision maker’s preferences change over time in a temporally inconsistent way. In this book, a time-inconsistent problem is viewed as a non-cooperative game between the agent’s current and future selves, with the objective of finding intrapersonal equilibria in the game-theoretic sense. A range of finance applications are provided, including problems with non-exponential discounting, mean-variance objective, time-inconsistent linear quadratic regulator, probability distortion, and market equilibrium with time-inconsistent preferences.

Time-Inconsistent Control Theory with Finance Applications offers the first comprehensive treatment of time-inconsistent control and stopping problems, in both continuous and discrete time, and in the context of finance applications. Intended for researchers and graduate students in the fields of finance and economics, it includes a review of the standard time-consistent results, bibliographical notes, as well as detailed examples showcasing time inconsistency problems. For the reader unacquainted with standard arbitrage theory, an appendix provides a toolbox of material needed for the book.

Drew Bell

Drew BellCompulsion Heidi Ayarbe - A Gripping Tale of Addiction...

Compulsion Heidi Ayarbe...

Guy Powell

Guy PowellThe Cottonmouth Club Novel - Uncovering the Secrets of a...

Welcome to the dark and twisted world of...

Ira Cox

Ira CoxThe Sociopolitical Context Of Multicultural Education...

Living in a diverse and interconnected world,...

Jesse Bell

Jesse BellThe Epic Journey of a Woman: 3800 Solo Miles Back and...

Embarking on a solo journey is a...

Cody Blair

Cody BlairFlorida Irrigation Sprinkler Contractor: Revolutionizing...

Florida, known for its beautiful...

Walt Whitman

Walt WhitmanUnveiling the Political Tapestry: Life in Israel

Israel, a vibrant country located in the...

Allan James

Allan JamesLife History And The Historical Moment Diverse...

Do you ever find yourself...

George Bernard Shaw

George Bernard ShawMiami South Beach The Delaplaine 2022 Long Weekend Guide

Welcome to the ultimate guide for...

Edison Mitchell

Edison MitchellAn In-depth Look into the Principles of the Law of Real...

The principles of the...

Caleb Carter

Caleb CarterExclusive Data Analysis Explanations For The October 2015...

Are you preparing for the Law School...

Alexandre Dumas

Alexandre DumasThe Secret to Enjoying Motherhood: No Mum Celebration of...

Being a mother is a truly remarkable...

Wesley Reed

Wesley ReedRace Walking Record 913 October 2021

Are you ready for an...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Natsume SōsekiThe Adventurous Heart Figures And Capriccios: Unveiling the Enchanting World...

Natsume SōsekiThe Adventurous Heart Figures And Capriccios: Unveiling the Enchanting World...

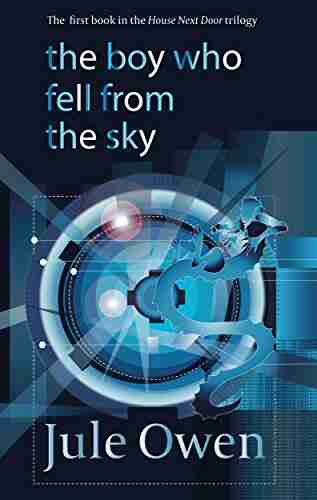

Julio Ramón RibeyroThe Boy Who Fell From The Sky: Unraveling the Mystery of The House Next Door

Julio Ramón RibeyroThe Boy Who Fell From The Sky: Unraveling the Mystery of The House Next Door Jean BlairFollow ·18.7k

Jean BlairFollow ·18.7k Cason CoxFollow ·4.1k

Cason CoxFollow ·4.1k Devin CoxFollow ·8.6k

Devin CoxFollow ·8.6k Hank MitchellFollow ·11.9k

Hank MitchellFollow ·11.9k Allan JamesFollow ·11.5k

Allan JamesFollow ·11.5k Hassan CoxFollow ·14.3k

Hassan CoxFollow ·14.3k Jerome BlairFollow ·7.3k

Jerome BlairFollow ·7.3k Garrett BellFollow ·7.1k

Garrett BellFollow ·7.1k