Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

5 Secrets to Raising a Prudent Child: Avoid Spoiling Them!

In today's fast-paced and consumer-driven world, it's becoming increasingly challenging to raise children who are not spoiled. As parents, we want our kids to grow up with financial responsibility and make wise decisions when it comes to money. So, how can we teach them to be prudent and not spoiled? In this article, we will unveil five secrets to help you achieve just that!

The Importance of Teaching Financial Prudence

Before we dive into the secrets, let's understand why teaching financial prudence to our children is crucial. By instilling the value of prudence early on, we empower our kids to become financially responsible individuals in the future. They will learn to weigh their options, make thoughtful decisions, and appreciate the value of hard-earned money.

Secret #1: Set Limitations

One of the pillars of raising a prudent child is to establish clear limitations. Allowances should be given based on age and specific tasks or chores. By doing so, your child will learn that money is not just handed out freely and that it requires effort to earn it. Setting limitations also teaches delayed gratification, as children will learn to save up for items they desire rather than becoming impulsive spenders.

5 out of 5

Secret #2: Encourage Saving

Saving money is a valuable skill that every child should learn. Encourage your child to set aside a portion of their allowance or any money they receive as gifts. You can even create a small savings jar or open a bank account for them. By fostering a habit of saving, you are teaching your child the importance of planning for the future and having a financial safety net.

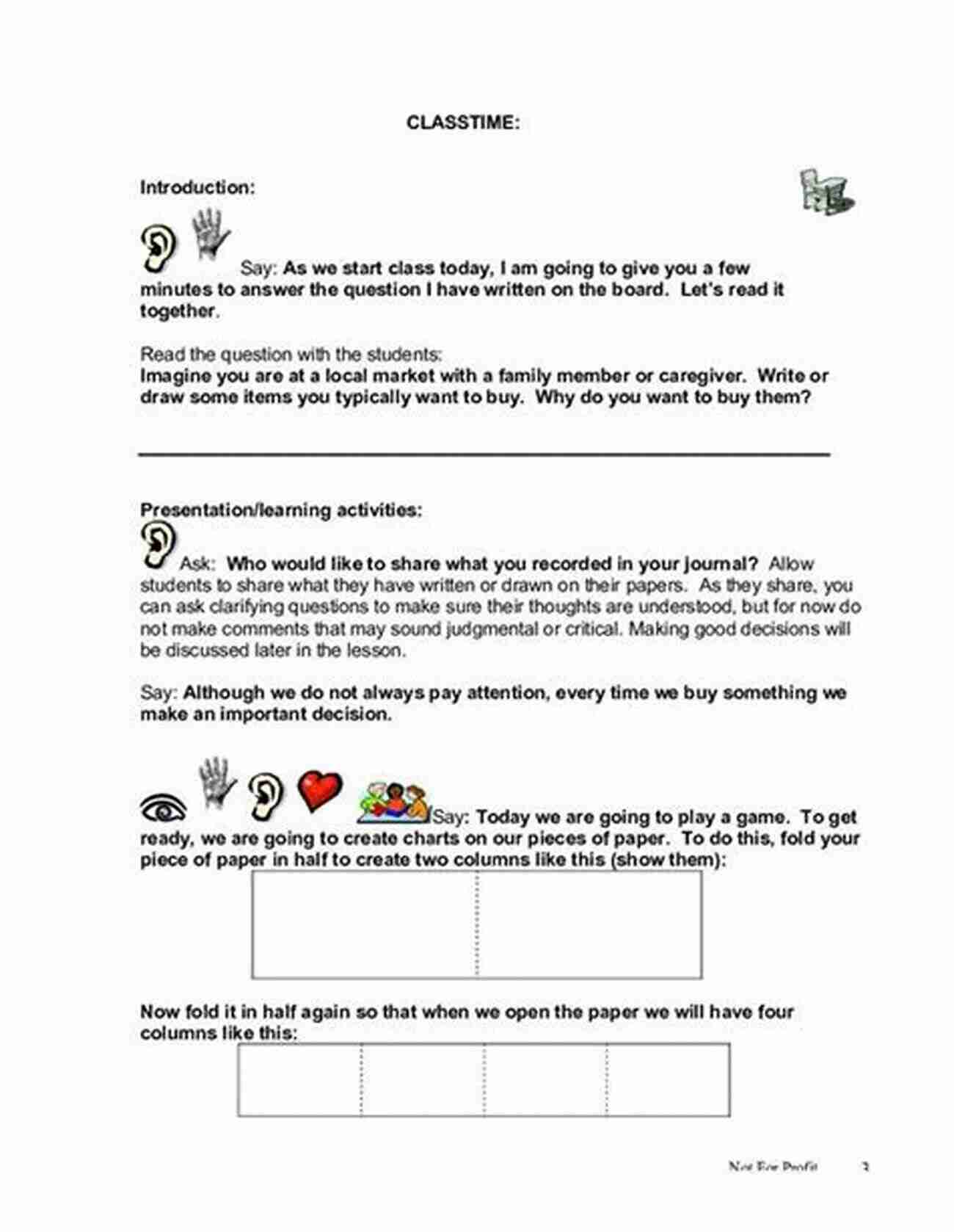

Secret #3: Teach Them About Budgeting

Budgeting is a skill that many young adults struggle with. By introducing budgeting concepts early on, you give your child a head start in managing their finances. Teach them to allocate their money wisely, set savings goals, and prioritize their spending. This will instill prudence and help them make informed decisions as they grow older.

Secret #4: Lead by Example

Children learn from observing their parents' behavior, so it's essential to lead by example. Show them how you handle money, such as saving for a family vacation or making wise purchasing choices. By being a financial role model, you demonstrate the importance of being prudent and avoiding unnecessary expenditures.

Secret #5: Teach the Value of Hard Work

The value of hard work cannot be emphasized enough. Teach your child that money is earned through effort and dedication. Encourage them to take up age-appropriate jobs or chores. This will not only help them understand the value of money but also develop a strong work ethic and sense of responsibility.

Raising a prudent child in today's materialistic world is undoubtedly a challenge. However, by following these five secrets, you can instill financial prudence in your child and equip them with the necessary skills to make responsible decisions. Remember, teaching financial responsibility is an ongoing process, so be patient and consistent in your efforts. Start now, and watch your child grow into a financially savvy and prudent individual!

5 out of 5

- Do your child(ren) understand where their money comes from?

- How have you explained this concept at different ages? What was the response?

- How early should you start the money talk?

- Perhaps your child(ren) has ADHD. How should you educate them about finances?

- What about digital money?

- Where you taught finances in school? What about your child(ren)? Are they being tutored on finances in school?

Talking about money matters is akin to talking about sex - if you don't, it will happen anyway, most likely when parents aren't around or by less than desirable individuals. This means that if we want our children (and grandchildren) to make good choices, we can't wait until they get old enough and start having kids (or grandchildren). So we need to engage them and be open, honest, and consistent in our conversations about money matters.

I'm not saying that every conversation should be a detailed discussion of the balance sheet - but even talking about fundamental concepts such as needs vs wants or how poor choices can create undesirable consequences (a la Candid Money) will go a long way toward setting children on the road toward healthy financial habits.

The book prudent and not spoiled is written in a straightforward and down-to-earth style, based on real-world experiences, grounded in practical knowledge and experiences from families with diverse incomes.

Sharon Bellweather shares her wisdom and personal experience of over a decade as a financial expert on the best way to teach children about money matters.

This book is a must-read for parents and aspiring parents. ORDER NOW

Drew Bell

Drew BellCompulsion Heidi Ayarbe - A Gripping Tale of Addiction...

Compulsion Heidi Ayarbe...

Guy Powell

Guy PowellThe Cottonmouth Club Novel - Uncovering the Secrets of a...

Welcome to the dark and twisted world of...

Ira Cox

Ira CoxThe Sociopolitical Context Of Multicultural Education...

Living in a diverse and interconnected world,...

Jesse Bell

Jesse BellThe Epic Journey of a Woman: 3800 Solo Miles Back and...

Embarking on a solo journey is a...

Cody Blair

Cody BlairFlorida Irrigation Sprinkler Contractor: Revolutionizing...

Florida, known for its beautiful...

Walt Whitman

Walt WhitmanUnveiling the Political Tapestry: Life in Israel

Israel, a vibrant country located in the...

Allan James

Allan JamesLife History And The Historical Moment Diverse...

Do you ever find yourself...

George Bernard Shaw

George Bernard ShawMiami South Beach The Delaplaine 2022 Long Weekend Guide

Welcome to the ultimate guide for...

Edison Mitchell

Edison MitchellAn In-depth Look into the Principles of the Law of Real...

The principles of the...

Caleb Carter

Caleb CarterExclusive Data Analysis Explanations For The October 2015...

Are you preparing for the Law School...

Alexandre Dumas

Alexandre DumasThe Secret to Enjoying Motherhood: No Mum Celebration of...

Being a mother is a truly remarkable...

Wesley Reed

Wesley ReedRace Walking Record 913 October 2021

Are you ready for an...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

William WordsworthDiscover the Untold Story of Mr Luck Trucks - The Ultimate Destination for...

William WordsworthDiscover the Untold Story of Mr Luck Trucks - The Ultimate Destination for... Donovan CarterFollow ·13.5k

Donovan CarterFollow ·13.5k Allen ParkerFollow ·13.1k

Allen ParkerFollow ·13.1k Gary CoxFollow ·14.1k

Gary CoxFollow ·14.1k Osamu DazaiFollow ·14.6k

Osamu DazaiFollow ·14.6k Francisco CoxFollow ·16.3k

Francisco CoxFollow ·16.3k George BellFollow ·4.5k

George BellFollow ·4.5k Christian BarnesFollow ·4.1k

Christian BarnesFollow ·4.1k Grayson BellFollow ·7.9k

Grayson BellFollow ·7.9k