Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

How To Raise Venture Capital For Your Startup

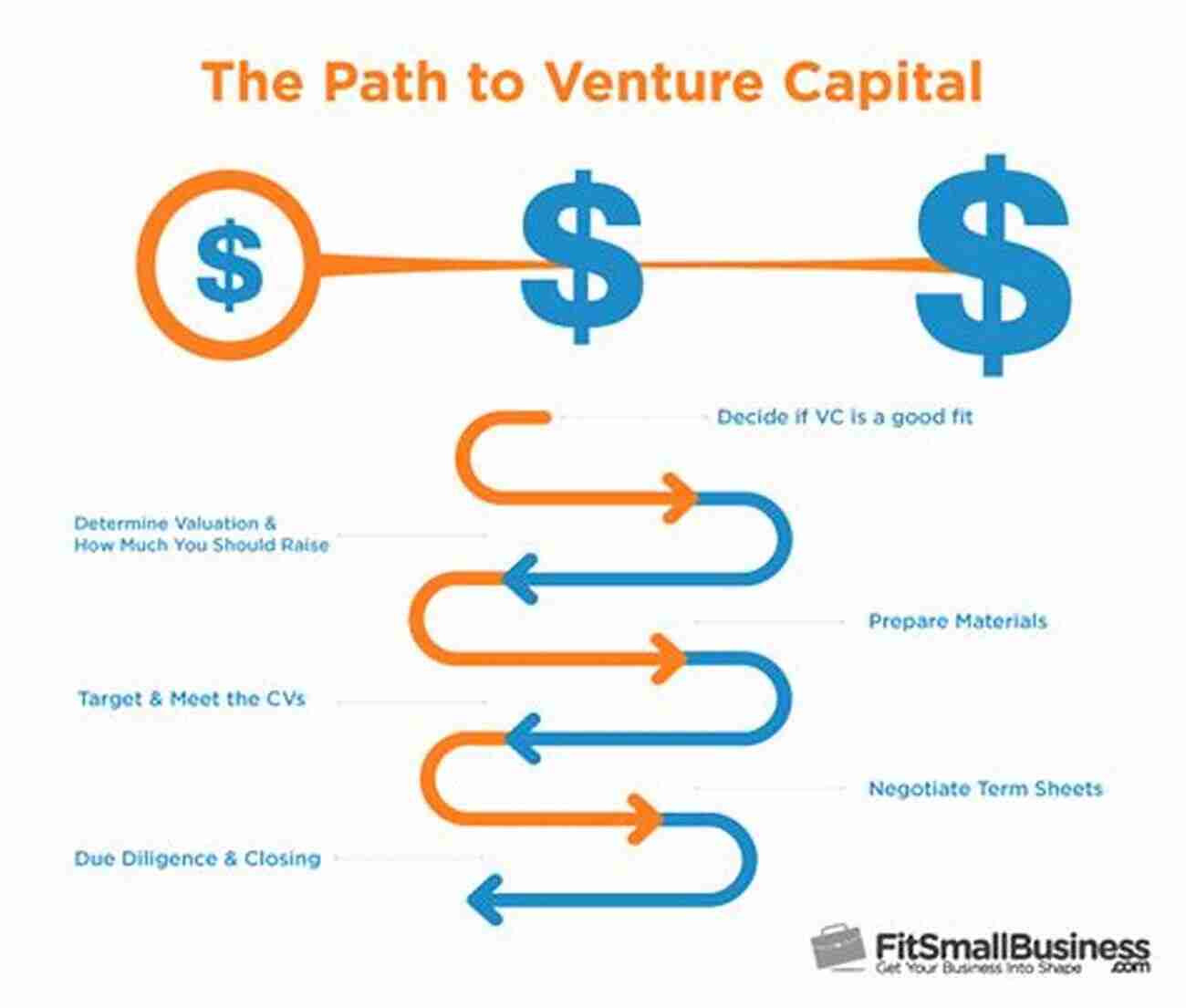

Are you an aspiring entrepreneur with the next big idea? Do you have a startup that needs funding to take off? If so, you may be considering raising venture capital. Venture capital can provide the capital injection and support needed to scale your startup and turn it into a successful business. In this article, we will guide you through the process of raising venture capital for your startup.

Understanding Venture Capital

Venture capital refers to the funding provided by investors to early-stage, high-potential startups in exchange for equity in the company. These investors are typically venture capital firms or individual angel investors who specialize in funding startups. Unlike traditional bank loans, venture capital investments involve a higher level of risk, but they also offer the potential for high rewards.

To raise venture capital, you need to convince investors that your startup has a unique and promising value proposition. You must demonstrate why your business has the potential for high growth and a significant return on investment. Below are the key steps to successfully raise venture capital:

5 out of 5

| Language | : | English |

| File size | : | 4641 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 183 pages |

1. Develop a Compelling Business Plan

A strong business plan is crucial when seeking venture capital. It should clearly outline your startup's mission, target market, competitive advantage, revenue model, growth strategy, and financial projections. Your business plan must convince investors that your startup has a scalable business model and a clear path to profitability.

2. Build a Solid Team

Venture capitalists not only invest in ideas but also in the people behind the ideas. Surround yourself with a team of talented individuals with relevant experience in your industry. Investors want to see a team that can execute the business plan effectively and navigate the challenges of a startup.

3. Network and Make Connections

Building relationships with potential investors is essential. Attend industry events, conferences, and networking sessions to meet venture capitalists. Leverage your personal and professional network to get s to investors. Engage in online communities and forums where you can connect with investors interested in your industry.

4. Prepare a Convincing Pitch

Your pitch must be clear, concise, and compelling. Highlight the unique value proposition of your startup, your target market, competitive advantage, and growth potential. Be prepared to answer detailed questions about your business model, monetization strategy, and scalability. Practice your pitch until it becomes second nature.

5. Conduct Due Diligence

Once you have sparked investor interest with your pitch, they will conduct due diligence on your startup. This includes evaluating your product or service, market potential, financials, legal documents, and your team. Be prepared to provide any necessary documentation and answer inquiries to the best of your ability.

6. Negotiate Terms

If investors see potential in your startup, they will present you with a term sheet outlining the investment terms and conditions. This is the stage where negotiations take place. Seek professional advice to ensure you fully understand the terms and protect your interests.

7. Close the Deal

Once the terms are agreed upon, it's time to close the deal. Lawyers will help finalize the legal documentation, and funds will be transferred to your startup's bank account. Celebrate your successful fundraising, as you now have the financial means to grow your startup and achieve your vision.

Raising venture capital for your startup is a challenging but potentially rewarding journey. It requires careful planning, a convincing pitch, and building relationships with investors. By following the steps outlined in this article, you can navigate the venture capital landscape and secure the funding needed to take your startup to new heights. Remember, patience and persistence are key, as the process may take time. May your startup flourish with the support of venture capital!

Sources:

- Entrepreneur - How to Raise Venture Capital for Your Startup

- Forbes - How To Raise Venture Capital For Your Startup

- Stanford Graduate School of Business - Does Relationship Capital Still Matter? Evidence from Investment Decisions and Returns

5 out of 5

| Language | : | English |

| File size | : | 4641 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 183 pages |

Are you a startup entrepreneur?

Do you have a multi-million dollar idea?

Are you worried on how to get funding for your business idea?

Then search no further, this book HOW TO RAISE VENTURE CAPITAL FOR YOUR STARTUP is the perfect solution for you.

With well researched and proven techniques, I will show you step by step how to raise venture capital for your startup.

In this book, you will learn the following:

- Fund-raising as an Art and Science

How to Pitch your Idea: Story, Screenplay and Direction

What are the Basics of a Business Plan?

How to Start Raising Capital

Essentials of a Business Plan

Basics of Writing an Effective Executive Summary

What is Disruptive Innovation?

Would you need to Update your Business Plan?

What Makes a Good Marketing Plan?

How to do Business Valuation for your Business Idea

Understanding Your Investors

Value Preposition and Distributions

Projections and Capitalization

Cash Flow Vs Income Statement

The Fund-Able Idea

The Perfect Pitch Deck

11 Must Have Deck Slides

To get this book scroll to the top of this page and click the buy now button!!!

Drew Bell

Drew BellCompulsion Heidi Ayarbe - A Gripping Tale of Addiction...

Compulsion Heidi Ayarbe...

Guy Powell

Guy PowellThe Cottonmouth Club Novel - Uncovering the Secrets of a...

Welcome to the dark and twisted world of...

Ira Cox

Ira CoxThe Sociopolitical Context Of Multicultural Education...

Living in a diverse and interconnected world,...

Jesse Bell

Jesse BellThe Epic Journey of a Woman: 3800 Solo Miles Back and...

Embarking on a solo journey is a...

Cody Blair

Cody BlairFlorida Irrigation Sprinkler Contractor: Revolutionizing...

Florida, known for its beautiful...

Walt Whitman

Walt WhitmanUnveiling the Political Tapestry: Life in Israel

Israel, a vibrant country located in the...

Allan James

Allan JamesLife History And The Historical Moment Diverse...

Do you ever find yourself...

George Bernard Shaw

George Bernard ShawMiami South Beach The Delaplaine 2022 Long Weekend Guide

Welcome to the ultimate guide for...

Edison Mitchell

Edison MitchellAn In-depth Look into the Principles of the Law of Real...

The principles of the...

Caleb Carter

Caleb CarterExclusive Data Analysis Explanations For The October 2015...

Are you preparing for the Law School...

Alexandre Dumas

Alexandre DumasThe Secret to Enjoying Motherhood: No Mum Celebration of...

Being a mother is a truly remarkable...

Wesley Reed

Wesley ReedRace Walking Record 913 October 2021

Are you ready for an...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Brenton CoxReviews Of Environmental Contamination And Toxicology Volume 246 - Uncovering...

Brenton CoxReviews Of Environmental Contamination And Toxicology Volume 246 - Uncovering...

Felix HayesThe Astonishing World of Nitrogen Fixation At The Millennium: Revolutionizing...

Felix HayesThe Astonishing World of Nitrogen Fixation At The Millennium: Revolutionizing...

Ignacio HayesPractical Guide To Successful Multigenerational Living: Creating Harmony in a...

Ignacio HayesPractical Guide To Successful Multigenerational Living: Creating Harmony in a...

Benji PowellThe Singletree Collection: Delighting Readers with Small Town Romantic Comedy

Benji PowellThe Singletree Collection: Delighting Readers with Small Town Romantic Comedy Robert BrowningFollow ·4k

Robert BrowningFollow ·4k Clark CampbellFollow ·3.3k

Clark CampbellFollow ·3.3k Ian McEwanFollow ·12.5k

Ian McEwanFollow ·12.5k Clinton ReedFollow ·13.9k

Clinton ReedFollow ·13.9k Dillon HayesFollow ·14.5k

Dillon HayesFollow ·14.5k Oliver FosterFollow ·2.5k

Oliver FosterFollow ·2.5k Ross NelsonFollow ·9.7k

Ross NelsonFollow ·9.7k Simon MitchellFollow ·8.8k

Simon MitchellFollow ·8.8k